Use Case

Manage Sensitive and Regulated Data with HubSpot’s Highly Sensitive Data Features

In heavily regulated industries, managing sensitive data requires stringent security and compliance measures. HubSpot’s customizable solutions provide advanced features that help financial services and healthcare firms handle client data with utmost care, adhering to regulations like the General Data Protection Regulation (GDPR) and the Health Insurance Portability and Accountability Act (HIPAA).

HubSpot ensures data protection through application-layer encryption with unique encryption keys for each customer, strict user access controls, and comprehensive audit logs for complete transparency. The introduction of “Highly Sensitive Data” features, such as property-level encryption, offers even greater privacy for critical data, including social security numbers and medical records.

These tools enable firms to streamline client data management securely and drive compliance without sacrificing operational efficiency.

Why You Should Pay More Attention to Managing Sensitive Data

Healthcare and financial services firms face significant challenges in managing client data due to the stringent regulations governing the industries. These challenges can broadly be categorized into the following areas:

1. Recordkeeping Requirements

You must comply with regulations such as SEC Rule 17a-4, which mandates retaining business records, including emails and client transactions, for up to six years. The scope of these records is vast. It often encompasses modern communication methods like instant messaging. Additionally, these records must be stored in non-erasable, non-rewritable formats (WORM storage), which can be both technologically complex and expensive to implement.

2. Cybersecurity and Data Protection

As cyber threats grow more sophisticated, firms must stay ahead of attackers while complying with rules like SEC Regulation S-P and FINRA Rule 4370. These require firms to implement robust cybersecurity frameworks and undergo frequent compliance audits. Furthermore, reliance on third-party IT and cloud vendors adds another layer of risk and complexity in ensuring secure data handling.

3. Know Your Customer (KYC) and Anti-Money Laundering (AML)

Regulations mandate robust processes to verify client identities and monitor transactions. However, aggregating data from various sources, particularly legacy systems, is often challenging. Screening systems may generate false positives that lead to time-consuming manual reviews. Continuous monitoring for compliance, especially as client circumstances evolve, adds to the operational burden.

4. Disclosure Obligations

Regulation Best Interest (Reg BI) requires firms to provide transparent disclosures about fees, risks, and conflicts of interest. Striking a balance between regulatory compliance and clear, client-friendly communication can be difficult. Regularly updating disclosure materials to reflect regulatory changes further strains resources.

5. Trading and Market Activity Surveillance

Financial services firms must monitor and report trading activities to prevent market manipulation and insider trading, as mandated by SEC Rule 613 and FINRA Rule 3110. Handling massive trading data volumes, ensuring algorithmic compliance, and meeting tight reporting deadlines remain persistent challenges.

6. Whistleblower and Reporting Obligations

The SEC whistleblower program incentivizes reporting securities violations. This means that your firm must maintain effective internal systems for addressing complaints while ensuring whistleblower protections. Public whistleblower cases, even if unfounded, pose reputational risks.

7. High Costs of Non-Compliance

Non-compliance can result in severe penalties, such as multi-million-dollar fines and reputational damage. You can also incur additional costs for remedial actions, including hiring external compliance consultants.

How to Address Data Management Challenges in Highly Regulated Industries

Invest in Technology

Use compliance software for recordkeeping, trade monitoring, and communication archiving.

Conduct Regular Audits

Periodic internal reviews ensure your processes align with FINRA and SEC rules.

Enhance Employee Training

Ongoing education on compliance requirements reduces the risk of inadvertent violations.

Engage Legal Experts

Work with legal and compliance consultants to interpret and implement complex regulations.

5 Reasons to Use HubSpot for Sensitive Data Management

Data Privacy Compliance

You can stay compliant with data privacy regulations by encrypting sensitive fields and tracking data access with audit logs.

Operational Efficiency

Centralized data in HubSpot’s secure CRM helps to streamline processes and facilitate efficient client data handling.

Controlled Access

HubSpot lets you set up role-based permissions that allow only authorized users to access or modify sensitive information.

Streamlined Data Management

You can use encrypted storage and permissions settings to manage sensitive data seamlessly and maintain long-term compliance.

Enhanced Client Trust

HubSpot also has robust security measures that demonstrate your organization’s commitment to data protection and strengthen client relationships.

5 Steps to Manage Sensitive Client Data with HubSpot

1. Map Data and and Analyse Sensitivity

Conduct a comprehensive audit to identify and classify data stored in HubSpot based on sensitivity levels, tailored to your industry’s needs.

Healthcare

Classify patient data, such as medical histories or insurance details, as highly sensitive and apply HIPAA-compliant encryption.

Financial Services

Categorize client financial information, such as account details or investment records, for enhanced protection under Financial Industry Regulatory Authority (FINRA) requirements.

Use HubSpot’s sensitive data properties to enforce encryption and apply granular security measures that align with these classifications.

2. Set Up Custom Properties

Create custom properties based on business and regulatory needs. Incorporate sensitivity settings from the start.

Healthcare

Add custom properties for patient data fields like diagnosis codes or treatment plans, with sensitivity settings that align with HIPAA compliance.

Financial Services

Set up properties for client portfolio details or transaction histories and make sure they meet encryption and compliance standards for secure handling.

Since sensitivity settings cannot be changed once applied, your administrators should assess future scalability and compliance requirements during initial planning to avoid rework.

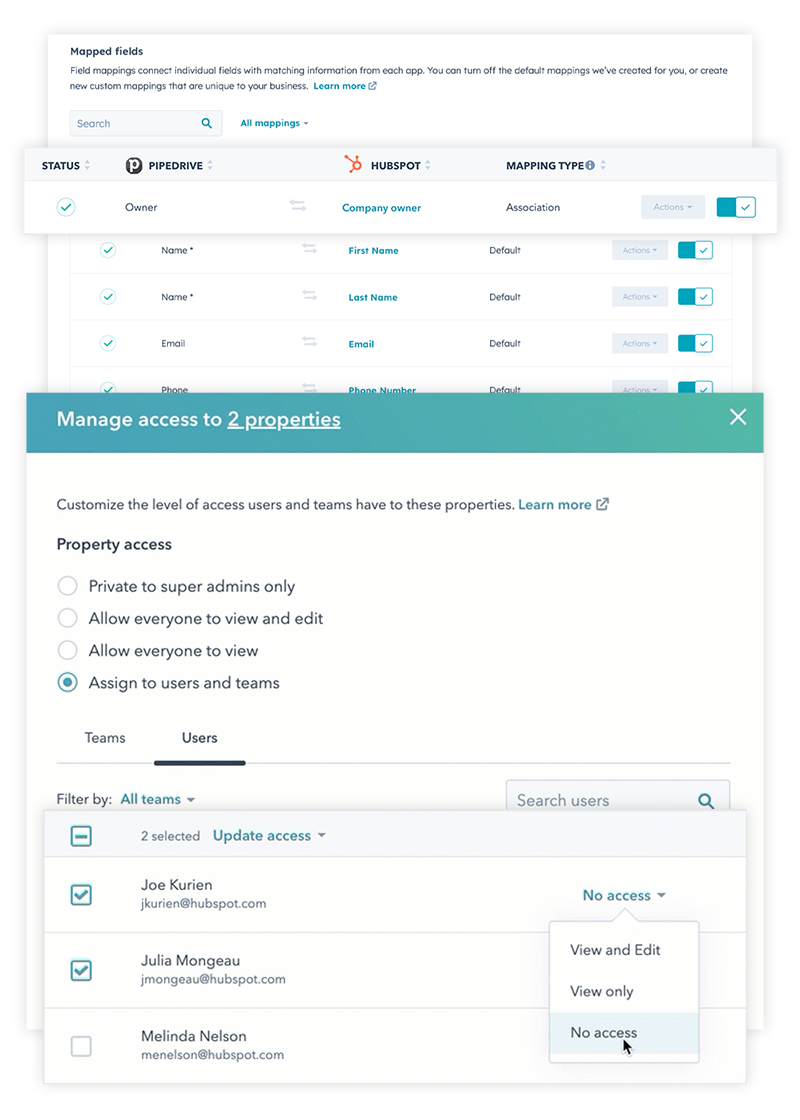

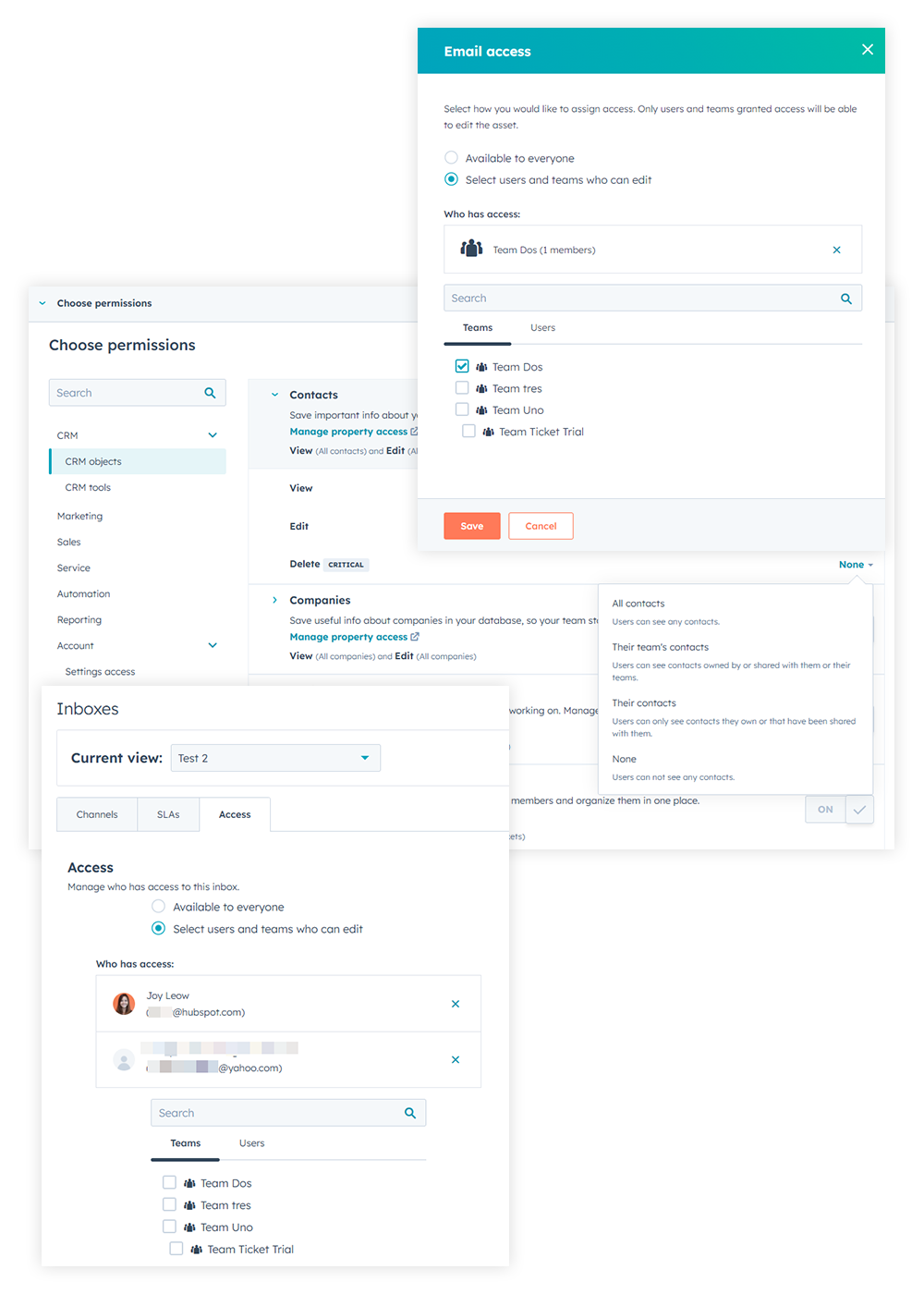

3. Manage Roles and Access

Leverage HubSpot’s role-based permissions to match data access with each employee’s responsibilities.

Healthcare

Grant access to sensitive patient data only to roles like compliance officers or medical administrators. For instance, restrict team members in marketing to de-identified or aggregated data.

Financial Services

Limit access to financial advisors for client account details, while ensuring marketing teams only see anonymized trends or aggregated data insights.

Regularly review and update permissions to reflect organizational and regulatory changes.

4. Plan Workflow and Automation

When designing automation workflows, account for restrictions on sensitive properties, such as personal health data or financial information, to ensure compliance with data privacy regulations.

Healthcare

Exclude sensitive patient data, like medical records or insurance details, from email personalization or workflow triggers. Instead, use anonymized placeholders for automated appointment reminders or follow-ups.

Financial Services

Avoid including client financial information, such as account balances or investment details, in automated workflows. Use aggregated data to generate personalized yet compliant client reports or alerts.

This approach ensures that workflows remain efficient while adhering to regulatory and organizational constraints.

5. Build Custom Integrations

Set up custom API integrations tailored to your industry to securely transfer sensitive data between HubSpot and other systems.

Healthcare

Integrate with tools like DocuSign to automate and encrypt patient intake forms and documents.

Financial Services

Connect with systems like PandaDoc to streamline loan agreement creation or financial reporting and apply token-based authentication and API scope restrictions.

These integrations enhance operational efficiency and safeguard data security and regulatory compliance.

Key Insights

-

1

Sensitive Data Limitations

Highly sensitive data properties in HubSpot must be accurately defined during creation, as their sensitivity settings cannot be modified or reclassified later.

-

2

Restrictions on Secure Properties

Secure properties cannot be used as unique identifiers, nor can they be scored, calculated, or included in personalization tokens. These limitations may affect workflow flexibility and require thoughtful planning to mitigate potential challenges.

-

3

Role-Based Control

Only Super Admins can designate a custom property as sensitive data. This highlights the importance of clear access planning during setup to minimize rework, maintain compliance, and ensure efficient operations.

Conclusion

Managing sensitive client data in heavily regulated industries, like financial services and healthcare firms, doesn’t have to be complicated. With HubSpot’s advanced encryption, access controls, and compliance tools, your organization can achieve a secure, efficient system that complies with stringent regulatory standards and strengthens client trust.

Implement the steps outlined above to safeguard and streamline your data management processes. If you want expert help to utilize HubSpot’s highly sensitive data functionalities and other intuitive tools, we’re happy to help. Schedule a consultation with one of our HubSpot subject matter experts.