Use Case

Pre-Dunning & Dunning Processes: How to Drive Payment Continuity for Subscription-Based Businesses

In every subscription-based service, maintaining an active debit/credit card on file is crucial for smooth transactions and renewals. However, payment cards can expire or be canceled at any time. This implies that subscribers need to receive effective prompting and notifications to update their payment information. Otherwise, the service will begin to experience high churn rates, among other business losses.

While there are default features available on hosting platforms, the pre-dunning and dunning processes offer a more proactive and effective approach to curb payment failures and other bottlenecks in the payment process. Read on to learn how to.

Proactive Measures: The Pre-Dunning Process

Responsive Action: The Dunning Process

Benefits of Pre-Dunning and Dunning Processes

Reduced Churn Rate

Early intervention through pre-dunning automation significantly reduces payment failures and customer churn.

Proactive Engagement & Improved Retention

Regular communication with customers through proactive notifications and reminders increases retention.

Enhanced Communication

Dunning automations deliver payment reminders and notifications in a non-intrusive manner that maintains a positive customer relationship and improves satisfaction.

Implementation Steps for Pre-Dunning and Dunning Automation

Create an effective communication plan

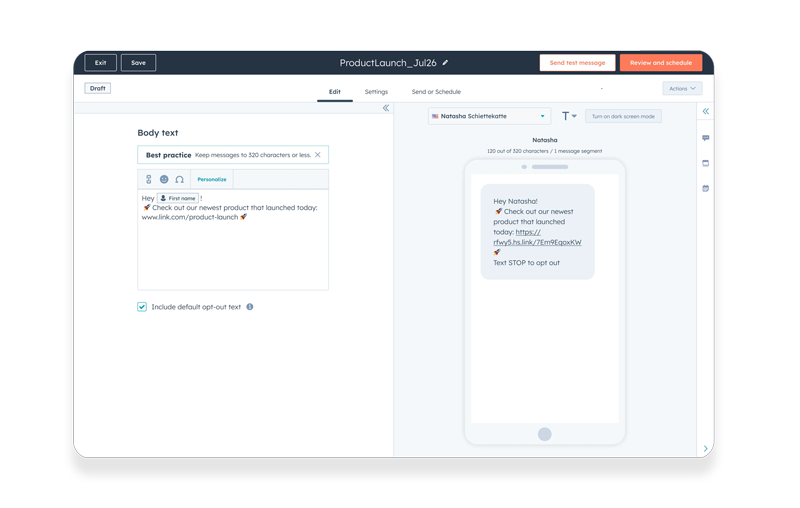

Develop clear, engaging emails and SMS messages to encourage customers to update their payment information.

Design a branded payment update page

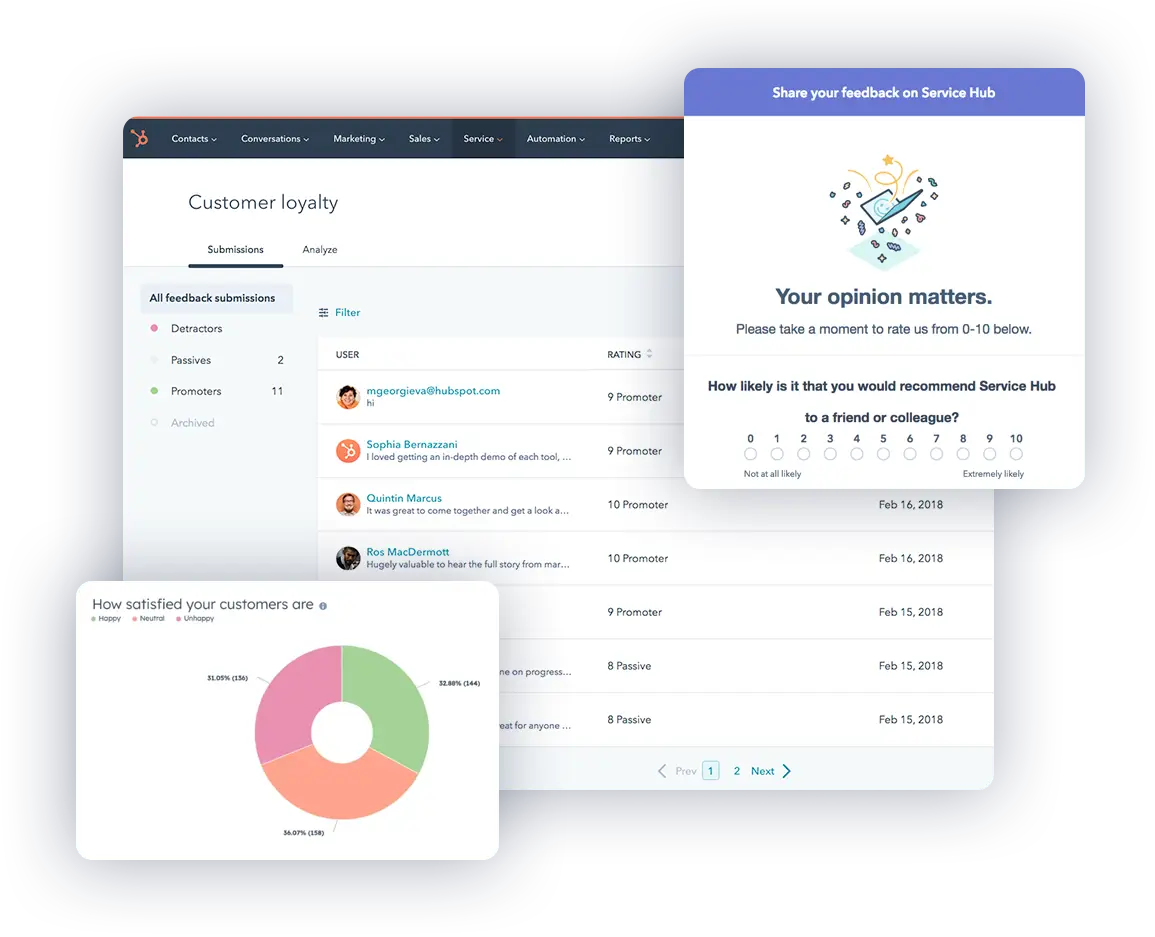

Collaborate with your design team to create a user-friendly, branded landing page on HubSpot or integrate your preferred CMS to build a page dedicated to payment updates.

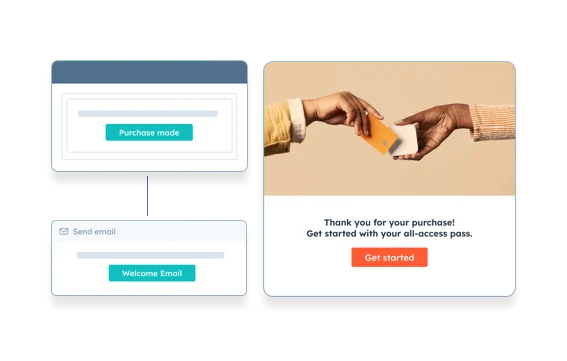

Automate notifications

Using a HubSpot workflow, set up automated reminders for upcoming renewals and potential payment issues.

Create regular reporting dashboards

Generate monthly reports on outstanding payments and customer engagement to identify areas for improvement.

Ensure seamless Integration

Have your pre-dunning and dunning automation go through a quality-check process to be sure it integrates smoothly with existing billing systems and aligns with your communication timeline.

Key Learnings from Pre-Dunning and Dunning Implementation

-

1

The pre-dunning process underscores the importance of proactive measures in managing subscription payments. By reviewing card expiration dates and sending timely reminders, you can prevent payment failures before they occur.

-

2

The two processes highlight the significance of communication in customer retention. Sending notifications and reminders to update payment information helps to maintain a positive relationship with customers and reduces churn rates.

-

3

Activating automated notifications and reminders for upcoming renewals and potential payment issues streamlines the payment process, makes it more efficient, and reduces the administrative burden on a business.

Conclusion

Pre-dunning and dunning processes help to maintain payment continuity in subscription-based businesses. By proactively managing payment information and engaging customers through timely notifications and reminders, your business is set to become more stable and profitable.

Want to get expert automation guidance for your subscription-based business?