Loan Process Automation

How We Reduced Fairway’s Loan Processing Time by 55%

Client Overview

Fairway Independent Mortgage Corporation’s Reverse Division solves the challenges of home equity conversion mortgage (HECM) processes. Founded in 1996, the organization specializes in a variety of mortgage solutions. Its commitment to efficiency and customer satisfaction continues to drive the need for innovative solutions in a complex finance sector.

Customer service is at the core of Fairway’s philosophy. Its commitment goes beyond finding the best rates, as it also prioritizes fast turnaround times and personalized guidance through the loan process. Its ultimate goal is to exceed customer expectations and build trust and satisfaction.

Challenges

The Reverse Division at Fairway faced a number of inefficiencies as a result of outdated, manual, and PDF-based process for handling reverse mortgages. The outdated method required loan officers to manually enter data into a five-page document. While the process managed to function, it was inefficient and error-prone, as documents needed to be emailed across various stages of the mortgage process.

The method resulted in several challenges for the Reverse Division:

- Time-Consuming Data Entry: Loan officers spent too much time manually entering data into the five-page PDF document, leading to decreased productivity and potential delays in processing reverse mortgage applications.

- Error-Prone Process: The manual data entry process increased the likelihood of errors. Pieces of information were incorrectly transcribed and omitted. These errors sometimes had serious consequences like incorrect loan calculations and delays in funding.

- Lack of Integration: The PDF-based process was not integrated with other systems. This made it difficult to track the status of reverse mortgage applications and share information seamlessly across departments.

- Limited Accessibility: The loan process relied on email for communication and document sharing. It was challenging for loan officers and other stakeholders to access and collaborate on reverse mortgage applications remotely or outside office hours.

- Data Fragmentation: With data scattered across multiple stages and systems, measuring marketing ROI and maintaining a clean data model was difficult.

Our Approach

To address these inefficiencies and mitigate the associated risks, Fairway recognized the need for a comprehensive solution that would streamline the reverse mortgage process, improve accuracy, and enhance overall operational efficiency.

We embarked on a comprehensive project that involved multiple phases and stakeholders.

Phase 1: Discovery and Planning

1. Stakeholder Workshops

We held workshops with key stakeholders across the mortgage processing chain, including loan officers, processors, and underwriters. Then, we identified pain points and gathered valuable insights into their daily workflows and challenges.

2. Business Requirements Definition

3. Technical Assessment

We evaluated the division’s existing technology landscape, including its Loan Origination System (LOS) to determine compatibility and integration points. We also identified potential risks and challenges and developed mitigation strategies.

Phase 2: Design and Development

1. Portal Design

We collaborated with a UX designer to create a user-friendly and intuitive portal interface.

Our team focused on streamlining the user experience and reducing the number of clicks required to complete tasks.

2. Custom Development

3. Quality Assurance and Testing

Phase 3: Deployment and Training

1. Deployment

Our team launched the portal on a secure and scalable cloud infrastructure; monitored performance; and made necessary adjustments to optimize the user experience.

2. User Training

Phase 4: Continuous Improvement

1. Monitoring and Evaluation

2. Agile Development

Solution Implemented

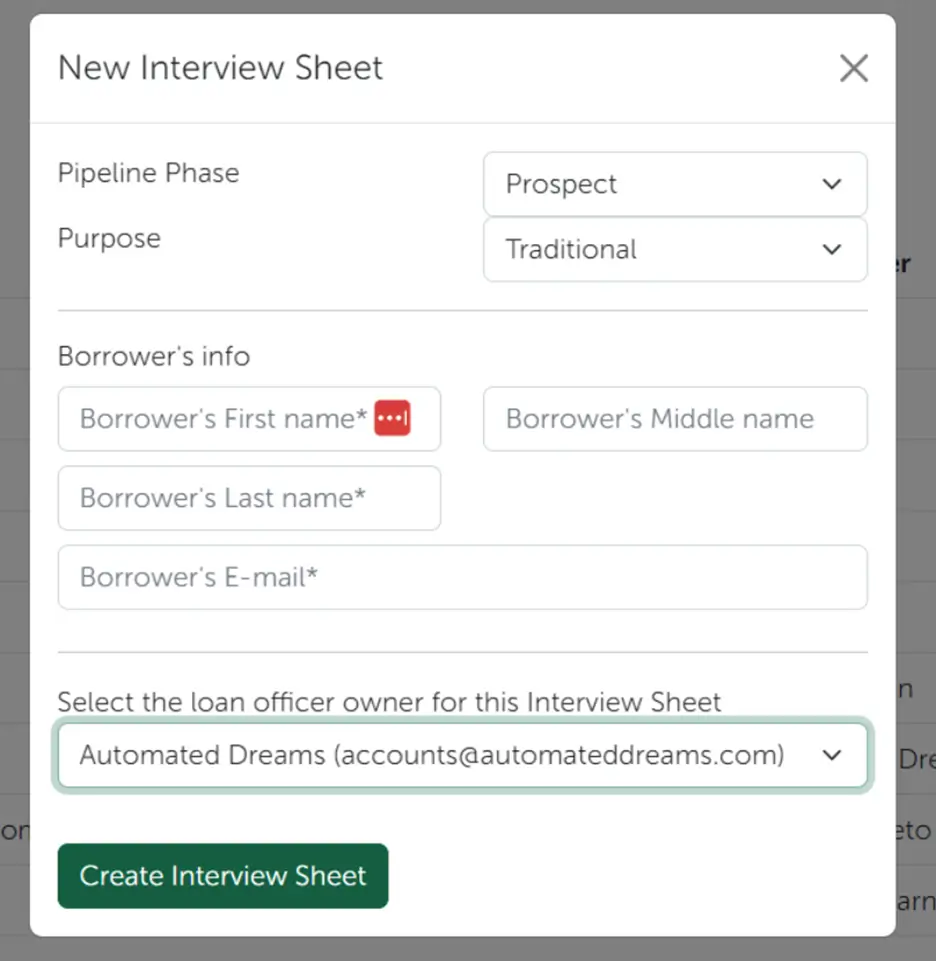

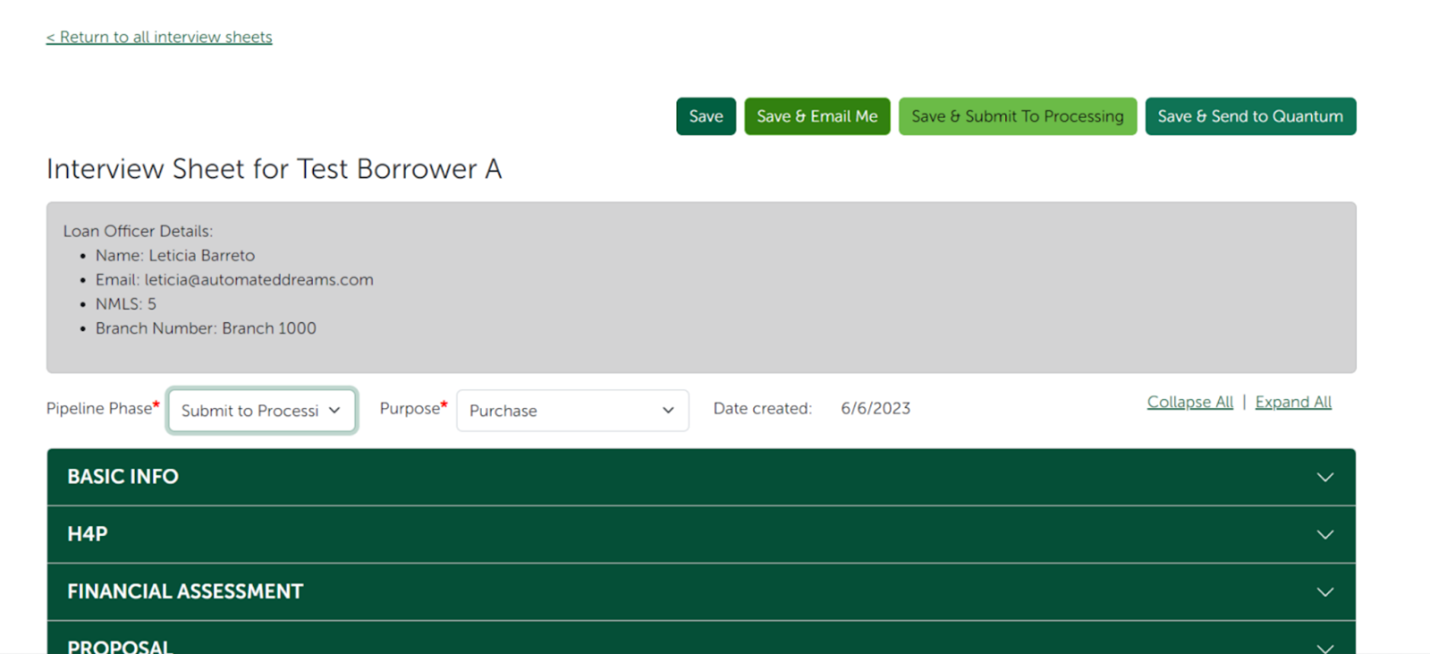

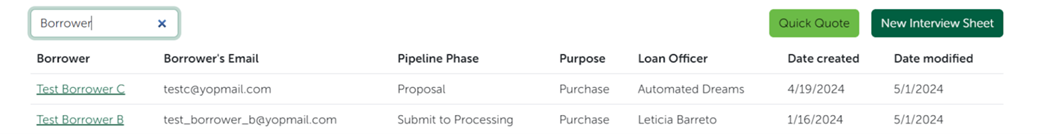

Our solution involved leveraging HubSpot’s robust CRM platform, developing a custom member portal, and using advanced serverless functions to create a secure, user-friendly “Interview Sheet Portal.”

This innovative portal streamlines the mortgage process for loan officers by allowing them to input necessary data at each step through a secure single sign-on (SSO). All information entered into the portal is seamlessly integrated with Fairway’s Loan Origination System (LOS) to facilitate a smooth workflow.

The portal also provides a centralized platform for loan officers to manage and track loan applications. It eliminates the need for manual data entry and reduces the risk of errors. It improves overall accuracy and compliance.

The portal enhances communication between loan officers and the rest of the team and enables real-time updates and notifications.

In addition to streamlining the loan application process, our solution offered several other benefits to Fairway, including:

- Increased efficiency: The portal automates repetitive tasks and frees up loan officers’ time to focus on more complex and value-added activities.

- Improved data security: The portal uses robust security measures to protect sensitive borrower information.

- Scalability: The portal is designed to handle high volumes of loan applications. It adapts as Fairway continues to grow and scale.

Results

Time Efficiency: The new system drastically reduces the hours previously spent on double data entry and manual form processing. The time spent on this process was reduced by 55%, going from 2.25 hours to roughly 1 hour per sheet.

Improved Data Integrity: Eliminating email-based document exchanges has significantly reduced errors and data inconsistencies to a minimum. The error rate has dropped by 10% from what it was previously.

Enhanced ROI Measurement: With clearer data pathways and integration, the Fairway team can now accurately track marketing efforts and their outcomes.

Streamlined Processes: Loan officers and back-office staff benefit from a more coherent and user-friendly system. This allows them to focus more on customer service and less on administrative tasks.

From the Horse’s Mouth

“Automated Dreams has been a solid and dedicated partner in our initiatives since June 2022. They’ve brought the flexibility and insight we needed and helped us evolve in our business practices. Their staff has worked diligently to understand the complexities of our business and rolled with the punches when we have made sharp turns. Would recommend the AD team to anyone.”

Tom Evans

EVP – Reverse Marketing & Technology at Fairway

Daniel McHarness

Sales Technology Manager

In a Nutshell…

We streamlined property listing management for Fairway through custom development, integration, and automation solutions. HomeScout and HubSpot empowered our team to deliver accurate and timely property information while enhancing customer satisfaction and operational efficiency for its reverse mortgage division.

If you’d like to reduce manual entry times, eliminate human errors, and experience the transformative power of automation firsthand in your processes, we’d love to help.

Let’s pave the way for enhanced efficiency, accuracy, and customer satisfaction in your operations.